Bridge AOR and bridgeMLS offices will be closed on Monday, September 1, in observation of Labor Day.

Bridge AOR and bridgeMLS offices will be closed on Monday, September 1, in observation of Labor Day.

NAR is pleased to share the latest consumer guide focused on how the VA Home Loan offers a great path to homeownership for current and former military service members.

As a reminder, all guides in this series are available for download—in both English and Spanish—on facts.realtor. Please allow a few days for the Spanish version of the latest resource to be translated and uploaded. For ease of reference, below is a list of the most recent guides:

Thank you for your continued engagement with the “Consumer Guide” series and for sharing the resources with prospective clients to ensure they have the information they need to find success in their homebuying or selling journey. Remember that these guides are for informational purposes only and are not meant to enact or change any existing NAR policy.

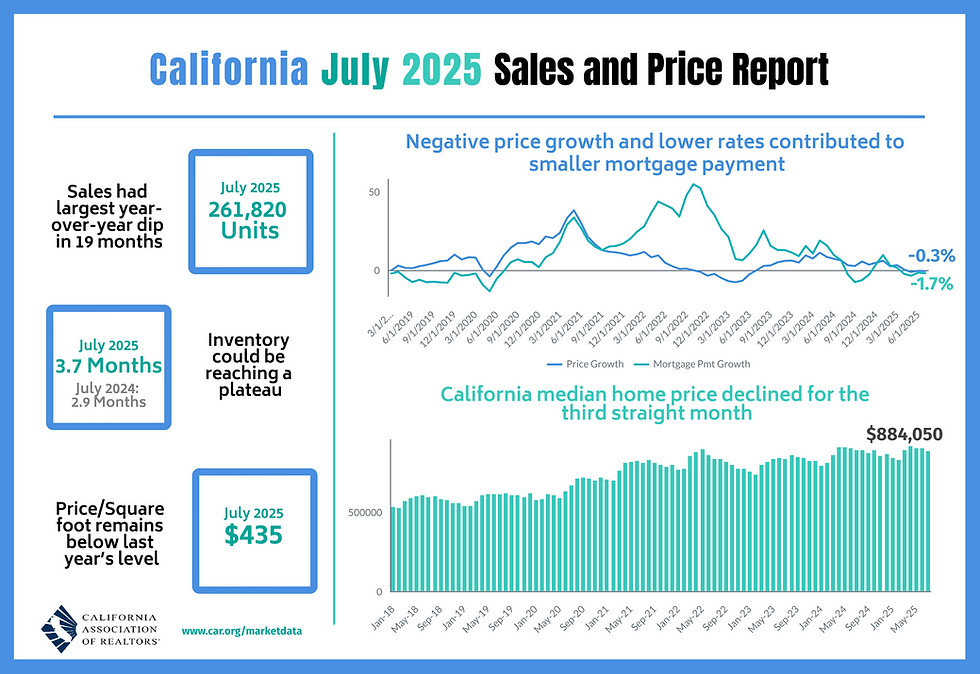

California home sales trail last year’s levels for fourth straight month, C.A.R. says

Existing, single-family home sales totaled 261,820 in July on a seasonally adjusted annualized rate, down 1.0 percent from 264,400 in June and down 4.1 percent from 272,990 in July 2024.

July’s statewide median home price was $884,050, down 1.7 percent from $899,790 in June and down 0.3 percent from $886,420 in July 2024.

Year-to-date statewide home sales were down 0.4 percent.

SACRAMENTO (Aug. 19) – California’s spring homebuying season continued to fall short of expectations, as elevated mortgage rates and growing economic concerns restrained home sales from year ago levels for the fourth straight month, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 261,820 in July, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2025 if sales maintained the July pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

July home sales activity dipped 1.0 percent from the 264,400 homes sold in June and was down 4.1 percent from a year ago, when 272,990 homes were sold on an annualized basis. July marked the fourth consecutive month of year-over-year sales declines, pushing the year-to-date sales into negative territory (-0.4 percent) for the first time in six months. It was also the 34th straight month in which the seasonally adjusted sales rate remained below the 300,000 benchmark.

Statewide pending sales slipped from last year’s level for the eighth consecutive month in July, registering the largest year-over-year decline since November 2023. While mortgage rates have dropped to their lowest level since October 2024, the latest uptick in inflation could reverse the recent rate improvement trend and push rates back up closer to 7 percent. As such, housing demand is likely to remain soft through August until buyers and sellers get a better sense of what direction the market and economy are going.

“The housing market experienced a modest slowdown in both sales and prices in July as some buyers stepped back, waiting for more certainty in the market and broader economy,” said C.A.R. President Heather Ozur, a Palm Springs REALTOR®. “Encouragingly, mortgage rates have recently declined to their lowest level since last October, and that has already led to an increase in purchase applications. If this trend continues, we could see stronger buyer activity and renewed demand in the months ahead.”

California’s median home price declined for the third consecutive month, falling to a five-month low of $884,050. The July figure was down 1.7 percent from June and also down 0.3 percent from $886,420 in July 2024. The July monthly drop is inconsistent with the long-run average of a 0.3 percent gain typically observed between June and July, suggesting the market could be bucking the usual seasonal pattern as elevated mortgage rates and economic uncertainty continue to soften demand and exert downward pressure on home prices.

“With housing inventory reaching a plateau and the statewide sales-price-to-list ratio hitting a near 30-month low, the market appears to be cooling off slightly as home prices dipped for the third straight month,” said C.A.R. Senior Vice President and Chief Economist Jordan Levine. “Even with recent price declines, California’s median home price could still see a modest annual increase in 2025, provided the market stabilizes in the coming months.”

Other key points from C.A.R.’s July 2025 resale housing report include:

At the regional level, non-seasonally adjusted home sales improved in only two of California’s five major regions on a year-over-year basis. The Far North edged out a 4.8 percent gain from a year ago, while the Central Coast surpassed last year’s sales by 1.7 percent. In contrast, the San Francisco Bay Area experienced the largest regional decline, with sales falling 4.1 percent, while Southern California (-1.7 percent) and the Central Valley (-1.5 percent) both recorded more modest pullbacks.

At the county level, 18 of the 53 counties tracked by C.A.R. recorded year-over-year sales gains in July, with half of those counties achieving double-digit sales growth. Imperial County (116.1 percent) was the only county with a triple-digit increase from a year ago, followed by Mariposa (91.7 percent) and Butte (41.6 percent). Thirty-four counties experienced annual sales declines in July, with nine counties dropping more than 10 percent including Mendocino (-26.7 percent), Lake (-22.6 percent), and Madera (-21.3 percent).

In July, only two of California’s five major regions saw year-over-year median home price increases, while two remained unchanged, and one declined. The Central Coast posted the largest gain at 4.9 percent compared to July 2024, followed by the Far North with a 3.1 percent rise. Prices in the Central Valley and San Francisco Bay Area held steady, while Southern California recorded a slight 0.7 percent dip.

At the county level, 31 of California’s 53 counties posted year-over-year median home price gains. Mono (56.5 percent) had the sharpest increase of all the counties, followed by Santa Barbara (32.4 percent) and Tehama (27.6 percent). Twenty-one counties experience price drops from a year ago, with Trinity (-19.2 percent) dipping the most, while Mendocino (-15.0 percent), and Plumas (-14.6 percent) recorded the second and the third steepest annual price declines in July, respectively.

July’s unsold inventory index (UII), which measures the number of months needed to sell the supply of homes on the market at the current sales rate, slipped from June, as fewer new listings came onto the market. The index was 3.7 months in July, a slight dip from 3.8 in June but up from 2.9 months in July 2024. On a yearly basis, the UII continued to post double-digit growth, with total supply surpassing last year’s levels for the 17th consecutive month.

Total active listings were up 37.7 percent from a year ago, reaching a 69-month high. That said, the pace of growth in total active listings decelerated for the third straight month, hitting its lowest rate in seven months.

The median number of days it took to sell a California single-family home was 28 days in July, up from 20 days in July 2024.

C.A.R.’s statewide sales-price-to-list-price ratio* was 98.5 percent in July 2025 and 100 percent in July 2024.

The statewide median price per square foot** for an existing single-family home was $435, down from $437 in July a year ago.

The 30-year, fixed-mortgage interest rate averaged 6.72 percent in July, down from 6.85 percent in July 2024, according to C.A.R.’s calculations based on Freddie Mac’s weekly mortgage survey data.

Note: The County MLS median price and sales data in the tables are generated from a survey of more than 90 associations of REALTORS® throughout the state and represent statistics of existing single-family detached homes only. County sales data is not adjusted to account for seasonal factors that can influence home sales. Movements in sales prices should not be interpreted as changes in the cost of a standard home. The median price is where half sold for more and half sold for less; medians are more typical than average prices, which are skewed by a relatively small share of transactions at either the lower end or the upper end. Median prices can be influenced by changes in cost, as well as changes in the characteristics and the size of homes sold. The change in median prices should not be construed as actual price changes in specific homes.

*Sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its original list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

**Price per square foot is a measure commonly used by real estate agents and brokers to determine how much a square foot of space a buyer will pay for a property. It is calculated as the sale price of the home divided by the number of finished square feet. C.A.R. currently tracks price-per-square foot statistics for 53 counties.

Leading the way…® in California real estate for 120 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with 200,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Sacramento.